Tell Esquire Group a bit about yourself

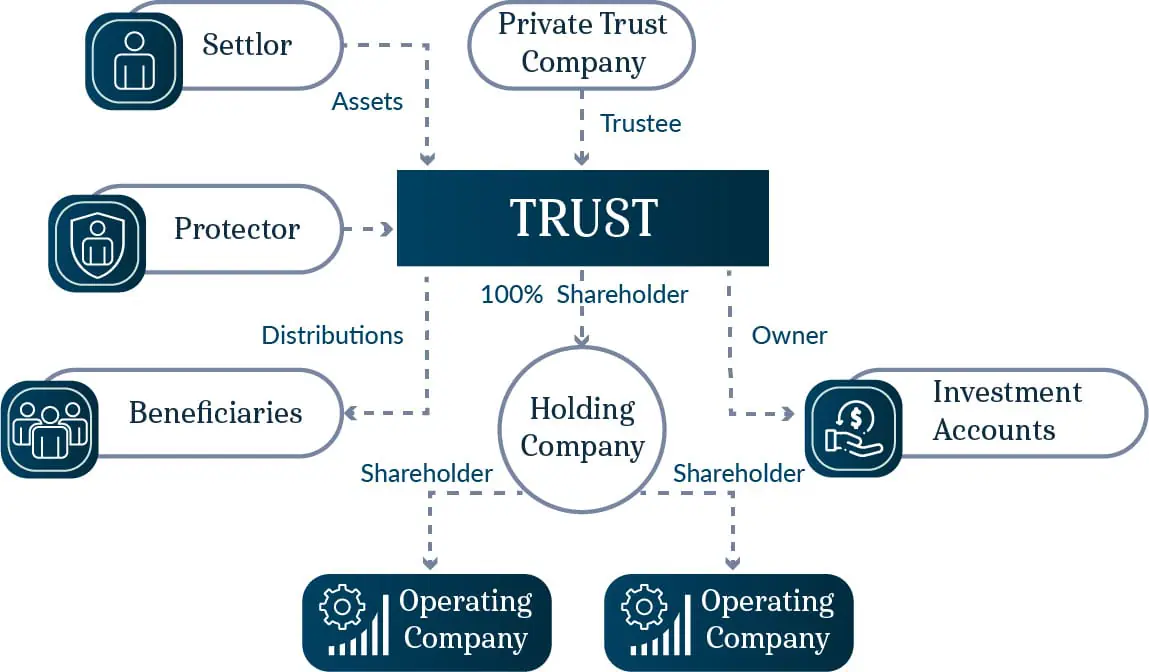

The Aeternum Trust is an irrevocable trust designed to optimize asset protection, privacy, and tax efficiency. It takes advantage of the modern Trust and Foundation laws in the UAE to provide a secure and advantageous wealth protection environment for citizens of any country.

Why Consider the Aeternum Trust: The Aeternum Trust offers several critical benefits that might not be available locally for individuals and families in their own country of residence. Especially in regions with unstable economic or legal systems or certain European countries like Switzerland, Germany and France which have too stringent financial reporting requirements and excessive financial oversight.

The trust is managed perpetually by your nominated trustee, whose job is to carry out your wishes. The option to replace trustees over time, also exists if needed. You can define the conditions or circumstances under which your trustee may be replaced.

Optional but recommended appointment of a protector or guardian to enhance oversight and enforce the trust’s terms. This provides a second layer of security ensuring the trustee's actions align with the settlor's wishes and the trust’s purpose.

There is no requirement for public registration of the trust details, maintaining a high level of privacy. This protects the identities of the settlor and beneficiaries, ensuring that personal and financial information remains confidential.

Trust Formation: Fast, efficient and thorough formation process supported by comprehensive legal guidance. Setup is usually completed within 30 days.

Asset Transfer: Once the trust is setup you can start to transfer assets into your Trust. This Is usually done with the assistance with your lawyer or tax advisor.

Management: Can be managed by a professional or private trust company (for even greater privacy), with beneficiary distributions following your precise specifications.

Maintenance: Regular reviews ensure ongoing compliance and adaptation to changing needs.

Task Involved | Who Does It | Cost |

One time Setup | Esquire Group | $24,500 |

Legal Asset Transfer+ | You and your lawyer | depends on assets |

Annual Oversight* (optional) | Trustees you appoint | $5,000 |

Annual Review (optional) | Esquire Group | $3,000 |

+ Asset transfer costs and related taxes can vary according to your home jurisdiction.

* Estimated costs for professional management company to manage the trust for you.